Does Your Ford F150 Qualify For Section 179 Tax Savings

Yes, your Ford F-150 can absolutely qualify for significant Section 179 tax savings! This valuable deduction allows businesses to fully expense the purchase price of a new or used vehicle, like many F-150 models, in the year it’s put into service, provided it’s used over 50% for business and meets the GVWR criteria. Don’t miss out on this powerful tax advantage for your business fleet.

Have you ever dreamed of a new Ford F-150? Maybe you picture it pulling a trailer full of tools to a job site. Or perhaps it’s delivering goods to happy customers. A powerful, reliable truck is often essential for many businesses. You might even know there are tax benefits for business vehicle purchases. But a big question often pops up: does your Ford F-150 qualify for Section 179 tax savings?

It’s a common thought for small business owners. You work hard, and every dollar counts. Finding ways to reduce your tax bill is smart. Section 179 of the IRS tax code can be a game-changer. It allows businesses to deduct the full purchase price of qualifying equipment. This includes certain vehicles. But there are rules. And understanding these rules, especially for a vehicle like the Ford F-150, is key.

This post will cut through the jargon. We’ll explain how your Ford F-150 might qualify for Section 179. We’ll cover the important details. We want to help you figure out if your new or used F-150 can bring you significant tax savings. Let’s dive in!

Key Takeaways

- Most F-150s Qualify: Many new or used F-150 models are eligible.

- Verify Business Use: Your F-150 must be over 50% for business.

- Check GVWR: Gross Vehicle Weight Rating (GVWR) must exceed 6,000 lbs.

- Consider Bed Length: A 6-foot or longer truck bed often aids eligibility.

- Understand Deduction Limits: Be aware of the annual Section 179 maximums.

- Leased Vehicles Count: Both purchased and leased F-150s can qualify.

- Consult Your Tax Pro: Always seek advice from a qualified tax professional.

📑 Table of Contents

- What Exactly is Section 179, Anyway?

- The “Heavy SUV” Rule: Where Your F-150 Comes In

- The “Business Use” Requirement: No Joyrides Allowed

- What F-150 Models Typically Qualify?

- Beyond Section 179: Other Tax Perks for Your Business F-150

- Estimated Ford F-150 GVWR Examples (Always Check Your Specific Vehicle!)

- Practical Tips and What to Watch Out For

What Exactly is Section 179, Anyway?

The Basics of This Business-Friendly Deduction

Think of Section 179 as a special tax break for businesses. Normally, when you buy a piece of equipment, like a new computer or a work truck, you deduct its cost over several years. This is called depreciation. Section 179 lets you do something different. It allows you to deduct the entire purchase price of qualifying equipment in the year you buy it and put it into use. That’s a huge difference for your cash flow!

This deduction is a big incentive for businesses to invest. It helps them grow and modernize. The IRS sets limits each year on how much you can deduct. For example, for 2024, the maximum Section 179 deduction is $1.22 million. This is for equipment placed in service by December 31st. Pretty generous, right?

Why it Matters for Your Business

The main reason Section 179 is so appealing is the immediate tax relief. Instead of small deductions over five or seven years, you get a big one upfront. This can significantly lower your taxable income. It puts more money back into your business right away. Imagine buying that new Ford F-150 for your business. Then you can write off a big chunk, or even all, of its cost this year. That’s real savings you can use for other business needs.

The “Heavy SUV” Rule: Where Your F-150 Comes In

Gross Vehicle Weight Rating (GVWR) is Key

This is where your Ford F-150 truly shines for Section 179. The IRS has a special rule for vehicles. It’s often called the “heavy SUV” rule. This rule applies to vehicles with a Gross Vehicle Weight Rating (GVWR) of more than 6,000 pounds. Many Ford F-150 models easily fall into this category.

Visual guide about does ford f150 qualify for section 179

Image source: storage.googleapis.com

What is GVWR? It’s the maximum loaded weight of the vehicle. This includes the vehicle itself, passengers, cargo, and any accessories. It’s not just the weight of the empty truck. You can usually find your truck’s GVWR on a sticker inside the driver’s side door jamb. This number is extremely important for Section 179 qualification.

The 6,000-Pound Loophole (and its Limits)

For vehicles with a GVWR under 6,000 pounds, the Section 179 deduction for passenger vehicles is much lower. For 2024, it’s generally capped around $19,500. That’s still nice, but not nearly as impactful. However, for trucks like many Ford F-150s with a GVWR over 6,000 pounds, this lower cap does not apply. This means you can potentially deduct the entire purchase price of your F-150 up to the full Section 179 limit (e.g., $1.22 million for 2024).

This is why understanding your F-150’s GVWR is so crucial. It can make a massive difference in your tax savings. The key, however, remains its primary use: business.

The “Business Use” Requirement: No Joyrides Allowed

Primary Purpose Must Be Business

This is a non-negotiable rule for Section 179. Your Ford F-150 must be used more than 50% for business purposes. This isn’t just a suggestion; it’s a strict IRS requirement. If you use your F-150 60% for business and 40% for personal use, you can deduct 60% of the qualifying cost. If it’s less than 50% business use, it doesn’t qualify for Section 179.

What counts as business use? Think about tasks like hauling tools and materials to job sites. Making deliveries for your small business. Driving to meet clients or visit suppliers. Transporting heavy equipment. These are all excellent examples. What doesn’t count? Your daily commute from home to your primary workplace, personal errands, or family road trips. These are personal uses.

Keeping Meticulous Records

The IRS loves documentation. And so should you! If you plan to claim Section 179 for your Ford F-150, you need solid records. This means keeping a detailed log of your business mileage. Note the date, starting and ending odometer readings, your destination, and the specific business purpose for each trip. There are many apps available today that can help you track this easily. Without clear records, it can be tough to prove your business use percentage if the IRS asks.

What F-150 Models Typically Qualify?

Checking Your Specific F-150’s GVWR

Most Ford F-150 models are built tough. They are designed for work. Because of this, many configurations naturally have a GVWR above 6,000 pounds. This is especially true for popular setups like SuperCab or SuperCrew trucks. If your F-150 has 4×4, a longer bed, or heavy-duty payload packages, it’s very likely to be over the 6,000 lb threshold. For example, a common F-150 Lariat 4×4 SuperCrew often has a GVWR between 6,600 and 7,050 pounds. This makes it a prime candidate for Section 179.

Again, always check the sticker on your driver’s side door jamb! That’s the definitive place to find your specific vehicle’s GVWR. Don’t guess. Don’t rely on online forums. Get the actual number.

Examples of F-150s that Might Not Automatically Qualify

While most F-150s qualify, there can be exceptions. Some very basic, lighter configurations might sneak under the 6,000-pound mark. This might include a base model Regular Cab, 2WD, with a short bed, and no heavy-duty options. If your F-150 does fall below 6,000 lbs GVWR, it can still qualify for a Section 179 deduction, but it will be subject to the much lower passenger vehicle limits mentioned earlier. So, even a smaller F-150 can still offer some Section 179 savings, just not the larger deduction.

Beyond Section 179: Other Tax Perks for Your Business F-150

Bonus Depreciation

Even if your Ford F-150 costs more than the Section 179 limit, you might not be out of luck for immediate deductions. Bonus depreciation is another fantastic tax incentive. It allows businesses to deduct an additional percentage of the cost of qualifying assets. For vehicles placed in service in 2023, it was 80%. For 2024, it steps down to 60%. This can be used in combination with Section 179. So, if your F-150 costs $60,000 and you deduct $20,000 with Section 179, you could then take 60% bonus depreciation on the remaining $40,000. It also requires more than 50% business use.

Deducting Operating Expenses

Don’t forget the ongoing costs of running your F-150 for business. Many of these are also deductible! Think about fuel, oil changes, regular maintenance, insurance, registration fees, and even new tires. You can deduct these expenses based on your business use percentage. You have two main ways to do this: the standard mileage rate or actual expenses. The standard mileage rate is a simple per-mile deduction. Actual expenses require you to track all your costs. Your tax professional can help you decide which method saves you more.

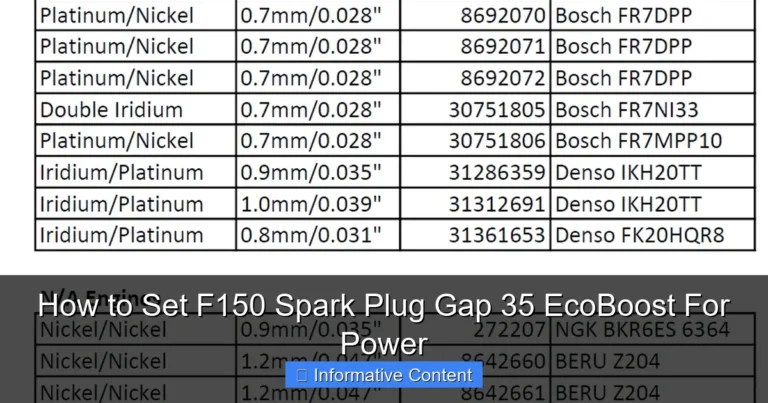

Estimated Ford F-150 GVWR Examples (Always Check Your Specific Vehicle!)

To give you a better idea of how different F-150 configurations usually stack up, here’s a general overview. Remember, these are estimates. Your actual vehicle’s sticker is the only source of truth.

| F-150 Configuration | Typical GVWR Range (Approximate) | Likely Section 179 Status (6,000 lbs rule) |

|---|---|---|

| Regular Cab, 2WD, Short Bed | 5,900 – 6,500 lbs | Potentially under or just over (check closely) |

| Regular Cab, 4×4, Standard Bed | 6,500 – 6,900 lbs | Likely qualifies |

| SuperCab, 2WD or 4×4, Standard/Long Bed | 6,600 – 7,000 lbs | Likely qualifies |

| SuperCrew, 2WD or 4×4, Short/Standard Bed | 6,700 – 7,100 lbs | Highly likely qualifies |

| Heavy-Duty Payload Package (any config) | 7,000 – 7,850 lbs+ | Definitely qualifies |

As you can see, most Ford F-150 trucks are designed with robust capabilities. This often places them squarely in the over 6,000 lbs GVWR category. This is great news for those looking to maximize their Section 179 tax savings.

Practical Tips and What to Watch Out For

Timing Your Purchase

For your Ford F-150 to qualify for Section 179 in the current tax year, it must be “placed in service” by December 31st of that year. This means you need to buy it and start using it for business before the year ends. Don’t wait until the very last minute! Getting all the paperwork sorted and the vehicle ready takes time. Plan ahead to ensure you don’t miss out on this valuable deduction.

The Importance of Professional Advice

Tax laws can be complex. They also change from year to year. While we’ve provided a lot of information here, it’s not tax advice. It’s always best to consult with a qualified tax professional or CPA. They can look at your specific business situation. They can help you calculate your exact deduction. They can also ensure you comply with all IRS rules. They can also help you compare Section 179 with other options like bonus depreciation to find the best strategy for you.

So, does your Ford F-150 qualify for Section 179 tax savings? The answer is a resounding “yes” for most F-150 owners who use their trucks for business. The key factors are your truck’s Gross Vehicle Weight Rating (GVWR) being over 6,000 pounds and using it more than 50% for business. This powerful deduction can significantly lower your taxable income in the year you buy your truck.

Before you make that big purchase or file your taxes, take a moment to check your F-150’s GVWR. Review your business usage. And most importantly, have a chat with your tax advisor. With a little planning, your dependable Ford F-150 can not only be a workhorse for your business but also a smart move for your financial health. Happy trails and happy savings!

Frequently Asked Questions

Is my Ford F150 eligible for the Section 179 deduction?

Yes, many Ford F150 models are eligible for the Section 179 deduction, especially if they are primarily (more than 50%) used for business purposes. Trucks like the F-150 often qualify due to their specific Gross Vehicle Weight Rating (GVWR) exceeding 6,000 pounds.

What are the key requirements for a Ford F150 to qualify for Section 179?

To qualify, your Ford F150 must be purchased and placed in service during the tax year you’re claiming the deduction. It must also be used for business more than 50% of the time, and it needs to be an eligible type of property, which trucks generally are.

Does the Ford F150’s Gross Vehicle Weight Rating (GVWR) affect its Section 179 eligibility?

Absolutely, the GVWR is a critical factor for Section 179. Many Ford F150 configurations, particularly SuperCrew models or those with larger engines and specific packages, have a GVWR exceeding 6,000 pounds, which exempts them from the stricter passenger vehicle depreciation limits and allows for a larger deduction.

How much Section 179 deduction can I claim for my qualifying Ford F150?

If your Ford F150 qualifies, you can potentially deduct the full purchase price up to the annual Section 179 limit, provided it’s used 100% for business. For mixed business and personal use, the deduction is prorated based on the business use percentage.

Can I claim Section 179 for a used Ford F150, or only a new one?

You can claim Section 179 for both new and used Ford F150 vehicles. The key requirement is that the vehicle must be “new to you” and placed in service for your business during the tax year, not necessarily brand new from the manufacturer.

Are there any limitations or exceptions to claiming Section 179 for a Ford F150?

Yes, if your specific Ford F150 model has a GVWR *under* 6,000 pounds, it will be subject to the much lower passenger vehicle depreciation limits, significantly reducing the available deduction. Additionally, the Section 179 deduction cannot be used to create a net loss for your business.