How Much is F150 Insurance Cost Per Year Learn the Truth

Featured image for f150 insurance cost per year

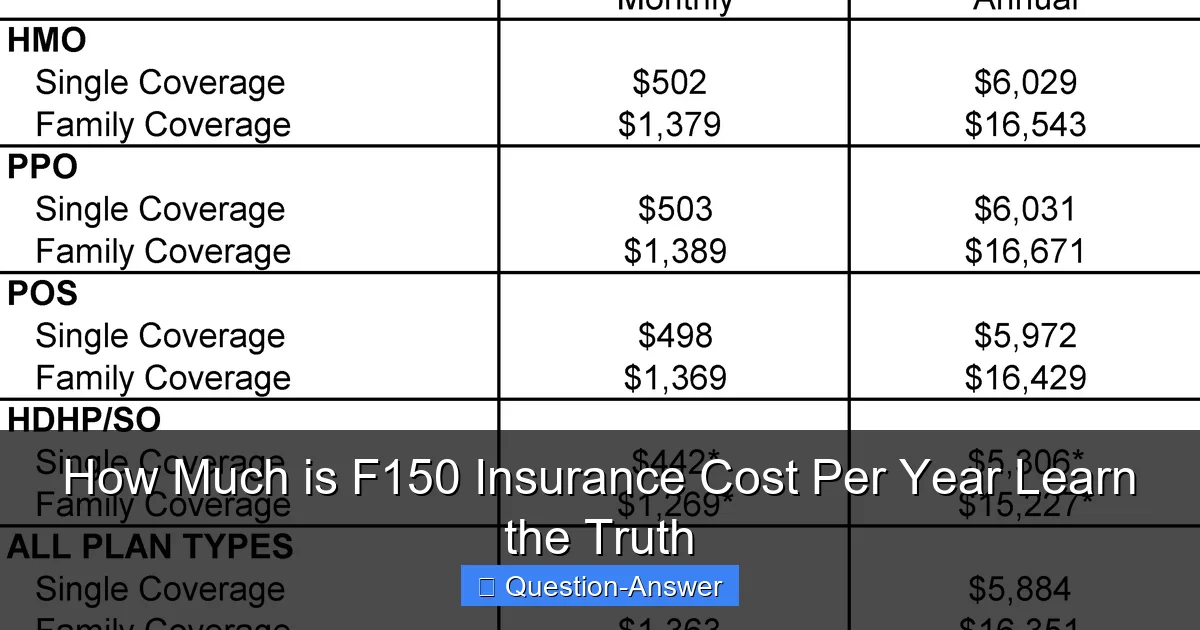

Image source: kff.org

F-150 insurance costs are not a fixed annual price but highly variable, typically ranging from $1,500 to over $3,000 per year depending on numerous factors. Key influences include your age, driving record, location, chosen coverage levels, and the specific F-150 model and year. To truly “learn the truth,” it’s crucial to compare personalized quotes from multiple insurers, as rates can differ significantly even for the same driver.

How Much is F150 Insurance Cost Per Year? Learn the Truth

Ever wonder, “How much is F150 insurance cost per year?” If you’re like me, you’ve probably searched for that exact phrase a few times. It’s one of those big questions when you own or are thinking about buying a Ford F150, right? The truth is, there isn’t one magic number. From what I’ve seen and experienced, the F150 insurance cost per year can swing quite a bit, typically landing somewhere between $1,500 and $3,000 annually. It really depends on so many things, making it a truly personal figure. But don’t worry, I’m here to break down exactly what goes into that number so you can get a clearer picture.

How Much is F150 Insurance Cost Per Year, and What Drives the Price Tag?

You know, when I first looked into my F150 insurance cost per year, I was surprised by how much it could swing between different quotes. It’s not just about the truck; it’s a whole mix of factors. Think of it like a recipe, where each ingredient affects the final taste – or in this case, the final price!

Here are the main ingredients that determine your F150 insurance cost per year:

- Your Personal Profile:

- Your Age and Driving Experience: Younger drivers or those with less experience often pay more. Insurers see them as a higher risk.

- Your Driving Record: This is huge. A clean record with no accidents or tickets is your best friend. A few speeding tickets, and suddenly, your rates jump up! I learned this the hard way with a minor fender bender years ago.

- Where You Live: Believe it or not, your zip code matters a lot. Urban areas with higher traffic, theft rates, or vandalism can mean a higher premium than rural areas.

- Your Credit Score: In many states, insurers use your credit-based insurance score as a factor. A better score can sometimes lead to lower rates.

- Your F150 Itself:

- The Year and Model: A brand-new F150 with all the bells and whistles usually costs more to insure than an older, more basic model. Why? Because it’s more expensive to repair or replace.

- Safety Features: Modern F150s come with amazing safety tech – things like lane-keeping assist, automatic emergency braking, and blind-spot monitoring. These can actually help lower your premium because they reduce the risk of accidents.

- Anti-Theft Devices: If your F150 has an alarm system or a vehicle recovery device, you might get a discount. Trucks, especially F150s, can be targets for theft.

- Your Coverage Choices:

- Liability Limits: This is the most basic coverage, protecting you if you cause an accident. Higher limits offer more protection but cost more.

- Collision and Comprehensive: Collision covers damage to your F150 from an accident, while comprehensive covers things like theft, vandalism, fire, or natural disasters. These are often the biggest chunk of your premium. When I hit a deer once, I was so glad I had comprehensive!

- Your Deductible: This is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible usually means a lower monthly premium, but be sure you can afford that deductible if something happens.

- Add-ons: Things like roadside assistance, rental car reimbursement, or gap insurance can add to your total.

My Personal Experience & Tips for Saving on F150 Insurance

Through years of owning F150s, I’ve picked up a few tricks that really help manage that F150 insurance cost per year. Here are my best tips:

- Shop Around Relentlessly: This is probably the biggest piece of advice. Don’t just stick with one company! I make it a point to get quotes from at least three different insurers every year or so. You’d be amazed at the price differences for the exact same coverage.

- Bundle Your Policies: If you have home insurance or another vehicle, see if you can bundle them with the same provider. I saved a decent chunk by combining my home and auto insurance.

- Maintain a Clean Driving Record: Seriously, avoiding tickets and accidents is the most impactful thing you can do for your rates. It shows you’re a responsible driver.

- Ask About Discounts: Always, always ask! There are so many potential discounts: multi-car, good student (if applicable), military, low mileage, professional affiliations, even paying your premium in full. You never know unless you ask.

- Consider a Higher Deductible: If you have an emergency fund set aside, opting for a $1,000 deductible instead of $500 can noticeably lower your premium. Just make sure that emergency fund is there!

- Look into Usage-Based Insurance: Some companies offer devices or apps that monitor your driving habits (like speed and braking). If you’re a safe driver, this could lead to discounts.

So, while there’s no single answer to “how much is F150 insurance cost per year,” by understanding these factors and applying these tips, you can definitely take control and work towards a more favorable rate for your fantastic truck. It’s all about being informed and proactive!